Changes to HSN Code Reporting in GSTR-1 (Effective May 2025)

- June 16, 2025

- Posted by: demanzo

- Category: Blog

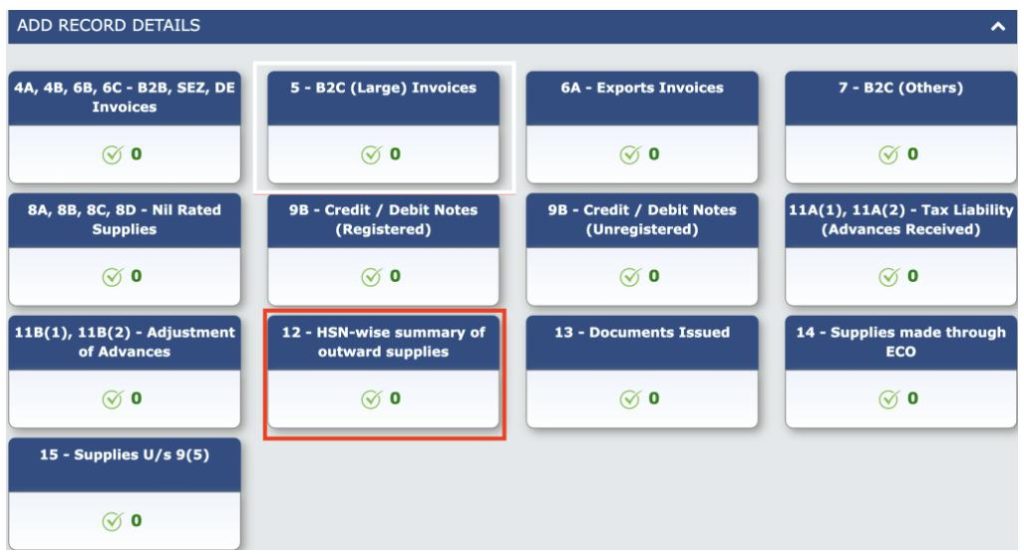

The Goods and Services Tax (GST) regime continues to evolve with regular reforms aimed at improving compliance, transparency, and data accuracy. One such change pertains to the reporting of HSN (Harmonized System of Nomenclature) codes in Table 12 of GSTR-1, which will be applicable from returns filed for May 2025 onwards.

Key Changes Under Phase 3 HSN Reporting

As part of the Phase 3 update, the GST portal will introduce the following modifications to Table 12 of GSTR-1:

1. Segregation of B2B and B2C Supplies

- Table 12 will now be bifurcated into two sections:

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- This allows taxpayers to report HSN-wise summaries of outward supplies separately for each category.

2. Restriction on Manual Entry of HSN Codes

- Taxpayers will no longer be allowed to manually enter HSN codes.

- Instead, HSN codes must be selected from a predefined dropdown list on the portal, helping ensure consistency and accuracy.

Practical Challenges Highlighted by Tax Experts

Despite the intent to streamline reporting, these changes have raised some practical challenges for filers:

A Tax expert CA Himank Singla highlighted the below issues on social media platform X.

Issue 1: No B2B Supplies in a Given Month

A scenario where a taxpayer has only B2C supplies for a particular month.

- Even in this case, the GST portal insists on entering HSN codes for B2B supplies in Table 12, creating confusion and unnecessary errors.

Issue 2: Only Amendments in Supply

Another situation arises when there are no new B2B or B2C supplies, but only an amendment to a B2B invoice that results in a reduction in B2C supply by the same amount.

- Despite no net change in aggregate supply, the portal still demands B2B HSN code entries, preventing smooth filing.

A Practical Workaround

To address these issues, CA Abhishek Mittal shared a workaround on social media platform X that has been well-received:

Solution:

In the absence of actual B2B supply, simply select any valid HSN code and enter zero values for value, tax amounts and other columns.

This allows the return to be filed successfully without triggering validation errors.

Final Thoughts

While these changes aim to strengthen reporting accuracy and eliminate inconsistencies in HSN data, some edge cases still require clarification and improvement from the GSTN side. Until then, the workaround suggested above can be a temporary fix for businesses encountering filing issues.

Stay updated on further changes and practical solutions by following trusted tax experts and the official GST portal.Need Help with GST Filing or ERP Integration?

Our team at ExpandX supports manufacturers and SMEs with seamless compliance and ERP solutions, including GST filing automation and real-time reporting tools.

📩 Contact us for a free consultation and let’s simplify your operations.